What Is GAP Insurance?

… A Must Have In Today’s World

What Does GAP Cover?

GAP pays the difference between the outstanding scheduled principal balance and the vehicle’s actual cash value, determined by your primary auto insurance carrier, on your auto loan or lease in the event of total loss or theft. GAP covers up to $1,000 of the borrower’s deductible if there is a ”GAP“ after the primary insurance settlement is paid.

Example |

|

|

Insurance Settlement Actual Cash Value 16,000 20,000 Insurance Deductible -1,000 -15,000 |

Loan Settlement Outstanding Loan BalanceInsurance Settlement |

| Insurance Settlement 15,000 5,000 | GAP |

GAP Statistics |

|

|

|

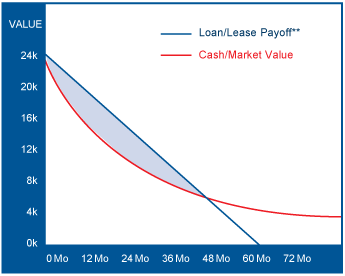

GAP Value Graph |

However, you may be surprised to learn that in the event of a total loss, the settlement amount received from your insurance company is the actual cash or market value of your vehicle. In many cases, this amount is less than what you owe the lender or lease company, and you are responsible for the difference.